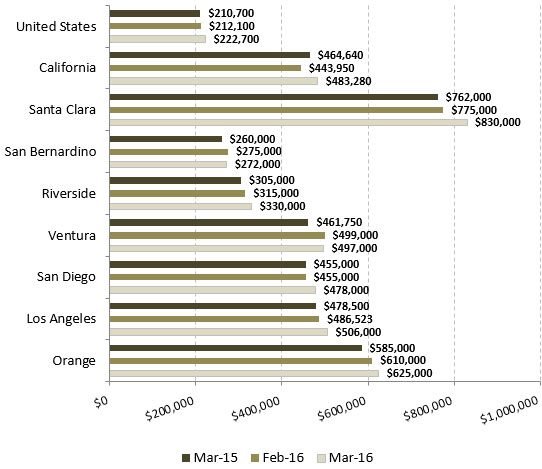

Median Home Prices in Orange County are up (as the chart below shows)

That’s nice to know, but the million dollar question is: Where are we headed?

Large Company New Home builders e.g. Shea, Pulte, KB Homes, William Lyon, Lennar, D.R. Horton and smaller companies e.g. MW Custom, Brandywine Homes, Olson Homes all have one thing in common – they do their homework.

Timing is everything in the real estate industry. I remember seeing vacant lots with “Coming Soon” signs all over Orange County just 1-2 years ago. How long did they sit vacant? Some of them were for 5 years or more. For example, the massive “La Floresta” master planned community in Brea at Imperial Hwy and Valencia Ave shows an electrical permit dating back to April 14, 2011!!! Over 5 years later, we see a vast array of trendy restaurants, Whole Foods market, and more homes still being built…

Why the delay? Van Daele Homes, Oakmont, and Del Webb all knew something…that the market would peak in 2016. Several of the homes purchased this year are still being built. These builders were willing to wait because the difference between $625,000 and $675,000 is considerable when you’re talking about hundreds of homes purchased. That $50,000 adds up. New Home buyers don’t seem to mind – after all, it’s exciting to buy something that smells so new, looks so fresh, and is walking distance to really cool amenities and shopping.

What this means for 2017 and beyond is that historically we see a drop off just after new home builds are bought out, the front yards are starting to look like front yards, the streets begin to resemble normal streets and the feel becomes more of a normal looking neighborhood without the mounds of dirt, construction trucks and lumber stacks. The dust settles, and the prices begin to drop. They know it, and they’re ok with it, because they made they’re money and moved on to other projects while the property management companies are left to deal with the problems.

This doesn’t mean these companies are bad – they’re just smart, and they invest too many millions of dollars to make a poor timing decision.

For resale homes (here defined as any home that is not newly built), there is a direct correlation with these new home builds. Housing markets reach peaks and these peaks are as much psychological as they are physical. We all know a huge interest rate hike would cause a drop off, but what about the common sense logic that 123 Main St., a small 3 Bedroom single family home in a nice neighborhood built in the 1960s is NOT REALLY WORTH $750,000??? Buyers begin to pull back on the horse’s reins and say “Whoa, Nelly” and more and more decide to wait for a pull back in the housing market. I hear the words “I’m waiting for prices to come down” quite often from visitors to my Open Houses. When this sentiment prevails, and more and more people are “on the fence,” the prices come down.

It takes a month, or two, or three…but there comes a time when people selling their homes begin to realize that they can’t get the prices their neighbor was getting in Spring of 2016. They may try, but after 3 weeks on the market with no offers close to their neighbors’ asking price, the thought starts to sink in – “I need to lower my price if I really want to sell this home.”

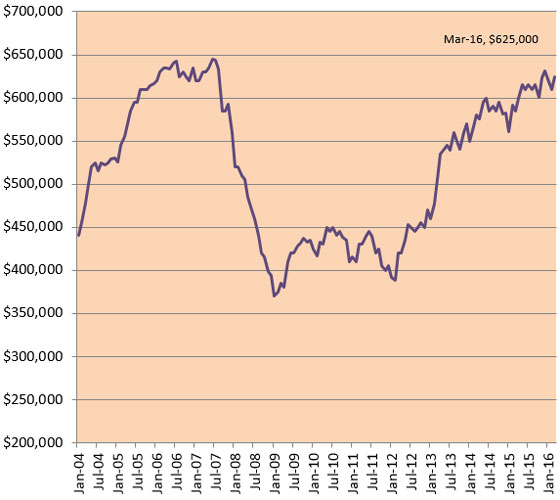

This shift from a Sellers’ Market to a Buyers’ Market is not overnight, but gradual as even the nicest of homes that once garnered multiple offers over the first open house weekend see an offer trickle in, every so often. Ultra careful buyers take their time, not as concerned they’ll “miss out” on this one. And a new normal is established. 6 months later some Data Company will represent this in the form of a chart that shows a drop off in home prices. Like, for example, this chart shows from 2007 to 2008:

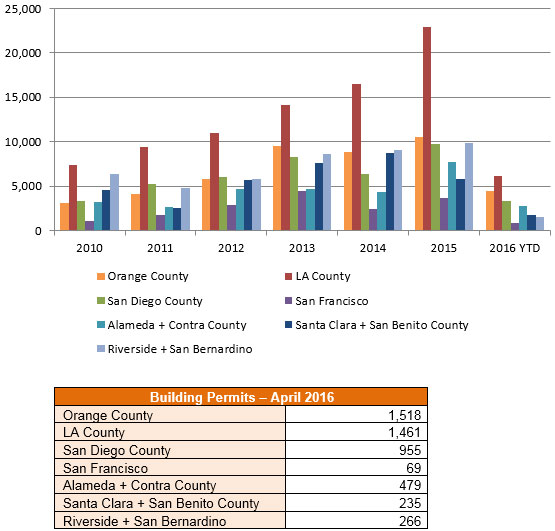

What the rest of this chart doesn’t show is that prices continued to go up in 2016…and then leveled off. But what is interesting is that the NUMBER OF BUILDING PERMITS issued in Orange County, although significantly lower than last year, was still a huge number for 2016

Building permits are issued long before the actual construction takes place, so we will continue to see a healthy amount of new homes going up in Orange County in 2017. This is a good sign for 2017 – I won’t stick my neck out and say we will maintain our 2016 median values, but I will say that there is a good chance that home prices won’t dip too much. In some cases (e.g. the $400,000 to $500,000 homes) there may even be a slight increase.

Looking to Buy or Sell? Call or Text the author of this article,

Nic Petrossi, TNG Real Estate Consultants (714) 272-3646

Email: Npetrossi@yahoo.com

Your comments and views are welcome!