Well here we are, it’s almost Halloween and it’s amazing how time flies!

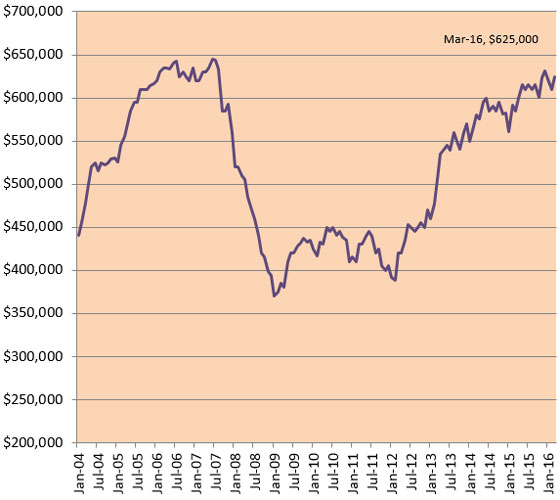

We have seen so much happen in the last 4 years…the housing BUBBLE DEFLATION (the “bubble” is looking more like a deflated jumper on the lawn of a 7 year old birthday party). We have seen banks scramble as they take back thousands of placentia homes, yorba linda homes and orange county homes back on their books. We have seen BLACK MONDAY when the stock market plunged with almost unprecedented decreases. (Scary, but felt almost the same way when I was watched the World Trade Center go down). It has been a very volatile last few years. Presently only home owners in North Orange County who bought homes 2003 or sooner have homes worth more than when they were purchased. It has taken 3 years for homes to go back down to 2004 values. Now, most buyers who have been sitting on the fence are eyeing the bank owned repos feeling that the best deals are in the foreclosure market. We’re seeing bank owned foreclosures with attracting multiple offers and agents in our Prudential Brea office are complaining that in some areas they cannot win the bidding war to get their client a home!

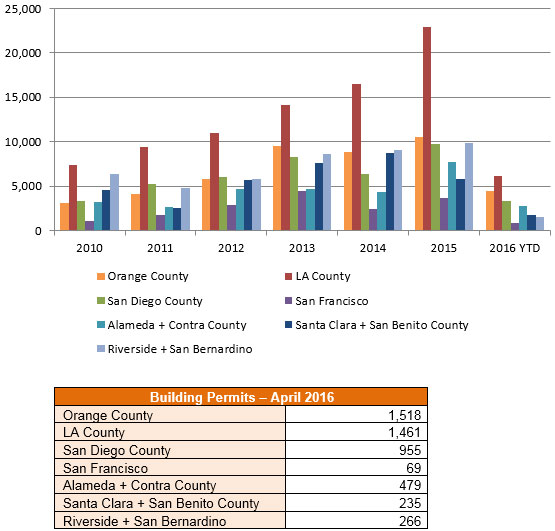

When you have multiple offers, you’re usually near the bottom of a downward trend. It has taken a long time, but sellers are finally becoming more realistic about the true worth of their home. Those that are unrealistic or just “testing the waters” of the market are taking their homes off the market when they sit for months and months with no serious offers. Less people put their homes on the market in September / October / November / December so what we’re seeing is a decrease in inventory for re-sale homes and an increase in the number of buyers entering the market who are hoping to time the “bottom” perfectly (like trying to buy when stocks are at their absolute lowest).

So, when is a good time to sell? Answer: Whenever you HAVE TO. I’m finding that sellers who HAVE to sell are selling their homes because they’re lowering their prices to attract offers. Sellers who WANT to sell will not sell their homes unless they’re willing to compete with the HAVE TO sellers and join the elite group who are pricing their homes under market, ahead of the bell curve. These are the sellers that will look back and be glad they did what they had to do. Those that played around with trying to get top dollar will be looking back saying, “Gosh darn, I should have been more aggressive.”